October 1, 2024

The September rate cut of .5% was the first reduction since 2020. Rate hikes resulted in the target range for the federal-funds rate hitting a two decade high of 5.25%-5.5%. This hiking cycle had the desired impact as the Fed’s preferred measure of inflation, the core personal-consumption expenditures index (PCE) came down to 2.6% in July, compared with a peak of more than 5.5% in 2022. While we are not yet at 2% inflation, the general trend has been in line with what the Fed would like to see, and policy remains restrictive, albeit less so than before the recent cut.

Voter polls indicate that the economy is the number one issue in this presidential campaign. Tax policy has taken on an outsized importance as the individual tax provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire at the end of 2025. With the government running close to $2 trillion in annual deficits and a wide range of voters opposed to tax increases, we may see changes to estate and gift taxes as an easy area to raise revenue.

Proposals to increase corporate taxes could negatively impact stocks. Some studies indicated the market added up to 10% in value after the corporate tax rate was cut to 21% from 35% previously. According to the Tax Foundation, raising the corporate tax rate back to 28% will, when combined with state and local taxes, land the U.S. at a total corporate tax rate of about 32.2%, second only to Columbia’s 35% in the world.

Another possible market negative would be the taxation of unrealized gains for high-net-worth individuals. Sweden, Germany and other countries have tried to tax unrealized gains and ultimately given up as forcing the sale of assets to pay the tax, particularly private ones like businesses or real estate, had a chilling impact on investment and growth.

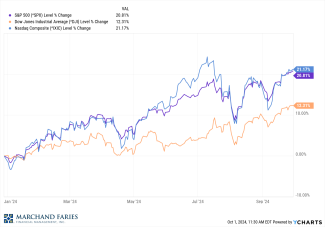

The yield on the 10-year Treasury note stands at 3.75%, and the yield on the two-year Treasury yield is at 3.55%. Year to date all major indices are still positive with the Dow, S&P 500, and NASDAQ at 12.31%, 20.81%, and 21.17%, respectively.

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.