Aside from volatility created by the ongoing tariff negotiations, companies have generally been reporting strong first quarter results for 2025 and more

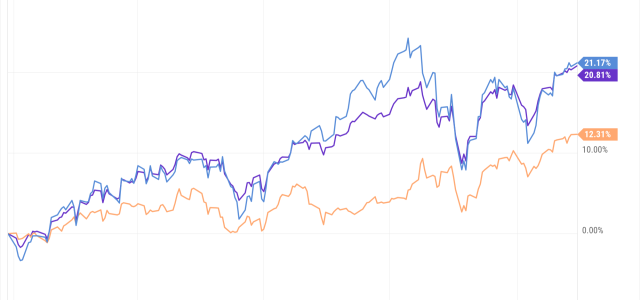

Clients often ask us about why rebalancing is important, selling a portion of securities that have performed well and buying an asset class that is

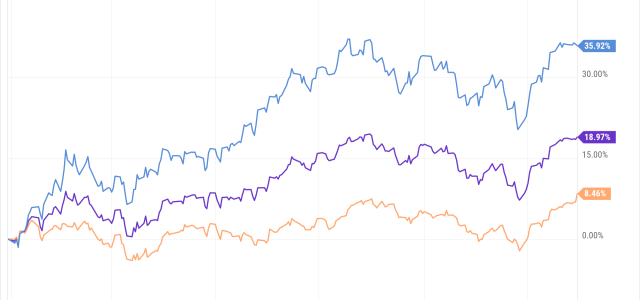

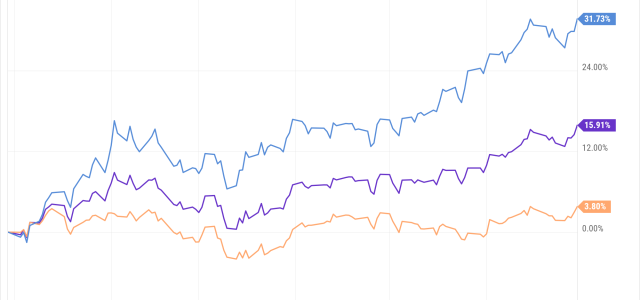

After two great years in the equity market, 2025 got off to another strong start with the S&P 500

making record highs driven by earnings growth and non

U.S. inflation increased by the most in eight months in December amid robust consumer spending on goods and services, suggesting the Federal Reserve would be in

As 2025 begins, we want to take a moment to thank you, our clients. As we have in the past, we want you to know that we will continue to do everything in our

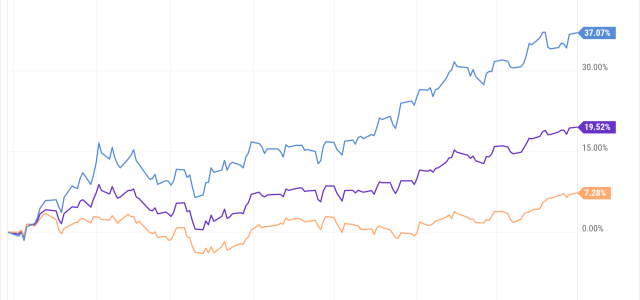

The September rate cut of .5% was the first reduction since 2020. Rate hikes resulted in the target range for the federal-funds rate hitting a two decade high

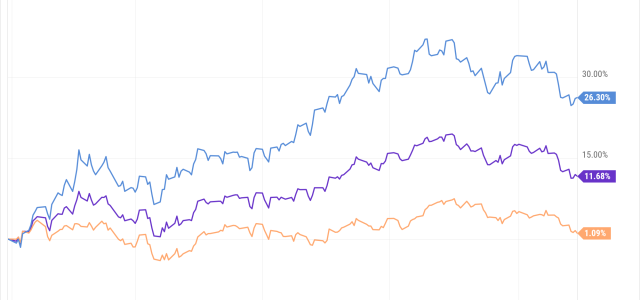

For most of the past two years, the markets have been primed with hope of a Fed pivot that will presumably restore easy monetary policy and supportive

October proved to be a volatile month for the markets. Major indices experienced fluctuations due to a variety of factors, including concerns over inflation

Wall Street had a rough September with the major indices slipping approximately 2% for the month.

Stocks struggled to shake off the downbeat mood hanging

August saw the equities markets give up some ground as interest rates continued to climb. Although the Federal Reserve believes the strategy is working to cool

The economy grew at a 2.0% annualized rate down from a 2.6% pace from the first quarter. Government spending, consumers and exports growth was strong at 5.0%, 7

June saw the markets digest the Federal Reserve’s pause in their rate hike regimen after additional evidence indicated that inflation was continuing to