December 1, 2023

For most of the past two years, the markets have been primed with hope of a Fed pivot that will presumably restore easy monetary policy and supportive conditions for the financial markets. If anything characterized the November results, it was the reflexive release of pent-up PIVOT expectation, on the belief that the Federal Reserve is finished with rate increases, and that the economy will enjoy a soft landing. Our impression is that this belief led to a sudden fear of missing out (FOMO) and eagerness to get in front of a Goldilocks economy combining continued economic growth with potential Federal Reserve easing. As is always the case, future earnings will be the key to sustained market appreciation, with blips like we have seen in November helping the markets’ overall mood.

Falling inflation and a cooler labor market has not stopped economic growth and the chance that we may achieve the soft landing that everyone has been hoping for. Keeping rates too high for too long would be an overkill if inflation continues to cool consistently.

The outcome of geopolitical events of October and November will likely impact the global economy in the long term as disruption in supply chains take months to filter down to the US economy.

Bonds extended gains fueled by dovish comments, with the 10-year Treasury yield (^TNX) — which moves inversely to prices — dropping about 6 basis points to around 4.27%, its lowest since September.

A fresh reading on US third-quarter GDP showed the US economy grew at a 5.2% annualized rate last quarter, revised up from the previous reading of a 4.9% pace. That reading comes as a recent commentary from Fed Governor Christopher Waller which has investors believing interest rate cuts could come sooner than initially expected.

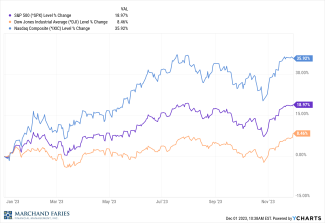

The yield on the 10-year Treasury note dipped to 4.27%, and the yield on the two-year Treasury yield dropped to 4.64%. Year to date the major indices closed with the Dow, S&P 500, and NASDAQ at 8.46%, 18.97% and 35.92% respectively.

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.