January 1, 2025

As 2025 begins, we want to take a moment to thank you, our clients. As we have in the past, we want you to know that we will continue to do everything in our power to warrant the confidence you have in our firm. The success of our clients in achieving each of their unique goals is of paramount importance to us.

2024 has been a positive year for stocks, with fixed income providing much needed stability during the dramatic volatility of the summer months. Geopolitical events continue with the various wars between Ukraine and Russia, Israel and Hamas, as well as ongoing tensions between China and Taiwan. Here at home political struggles after the presidential election have made 2024 noteworthy in many respects, with the GOP technically controlling all three branches of the government. The challenge will be to prove to the electorate that promises made can be kept and spending of taxpayer money will be done with an eye toward fiscal responsibility.

The impact of the changing global landscape and on financial markets has resulted in a degree of uncertainty that is familiar to long-term investors. There is always an impact of outside forces or black swan events on the movement of stock and bond investments. This is why we continue to emphasize quality, diversification, and rebalancing.

The bond market is starting to normalize with short-term rates declining and long-term rates rising. The battle for a lower inflation rate is one of the biggest challenges of the incoming administration. Fiscal responsibility on the part of the government seems to be a concept now welcomed by all parties, although the actual implementation of cutting spending is always the sticking point.

We look forward to 2025 with cautious optimism that corporate earnings will continue to grow, and the economy will show resilience in tamping down inflationary pressures.

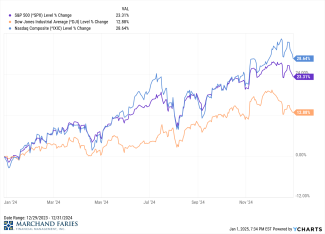

The 10-year Treasury note is currently yielding 4.55%, while the yield on the two-year Treasury yield is at 4.24%. For 2024 the major indices are all positive with the Dow, S&P 500, and NASDAQ at 12.88%, 23.31%, and 28.64%, respectively.

Wishing you all a safe, healthy, and prosperous New Year!

*Disclaimer: This report is a publication of Marchand Faries Financial Management, Inc. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgement of the author as of the date of publication and are subject to change.