The US economy is set to slow, although a recession this year is unlikely. Even though the Federal Reserve is not ready to cut interest rates just yet, the

Equities markets experienced a rough patch in April declining about 7% with another hot inflation reading indicating that any near-term interest rate cuts are

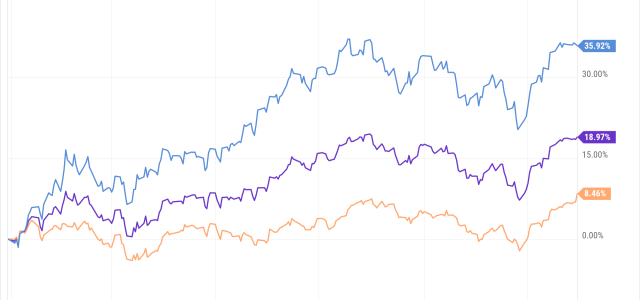

March saw U.S. equities end the month higher as the S&P 500 had its best first quarter since 2019. Expectations for rate cuts in 2024 have moderated as real GDP

The stock markets have continued their upward trend with the S&P 500 closing above 5,000 for the first time in history. Looking ahead to the next few months

Although we are not out of the woods yet, the US economy is beginning 2024 in a far better place than most investors expected. Although the Federal Reserve is

What a difference eight weeks makes in the markets! At the end of October, the Dow was slightly negative with the S&P 500 and Nasdaq posting respectable but not

For most of the past two years, the markets have been primed with hope of a Fed pivot that will presumably restore easy monetary policy and supportive

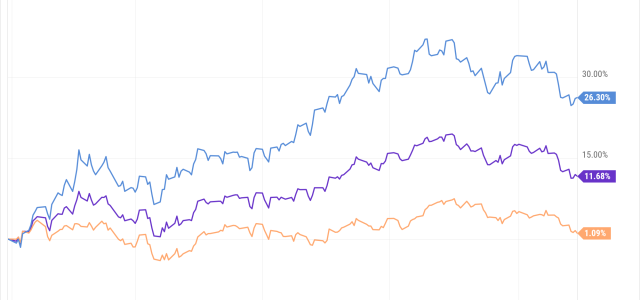

October proved to be a volatile month for the markets. Major indices experienced fluctuations due to a variety of factors, including concerns over inflation

Wall Street had a rough September with the major indices slipping approximately 2% for the month.

Stocks struggled to shake off the downbeat mood hanging

August saw the equities markets give up some ground as interest rates continued to climb. Although the Federal Reserve believes the strategy is working to cool